lhdn approved donation list

Written by Tharmini Kenas The Inland Revenue Board LHDN has recently raised the donation reporting threshold from RM5000 to RM10000. Lhdn Approved Donation List Register As A Taxpayer With Lhdn Docx Register As A Taxpayer With Lhdn Registration And Status Checking Can Be Done Online At Edaftar Hasil.

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

Your BEBBTMMT session has expired on 11-October-2022 070437454.

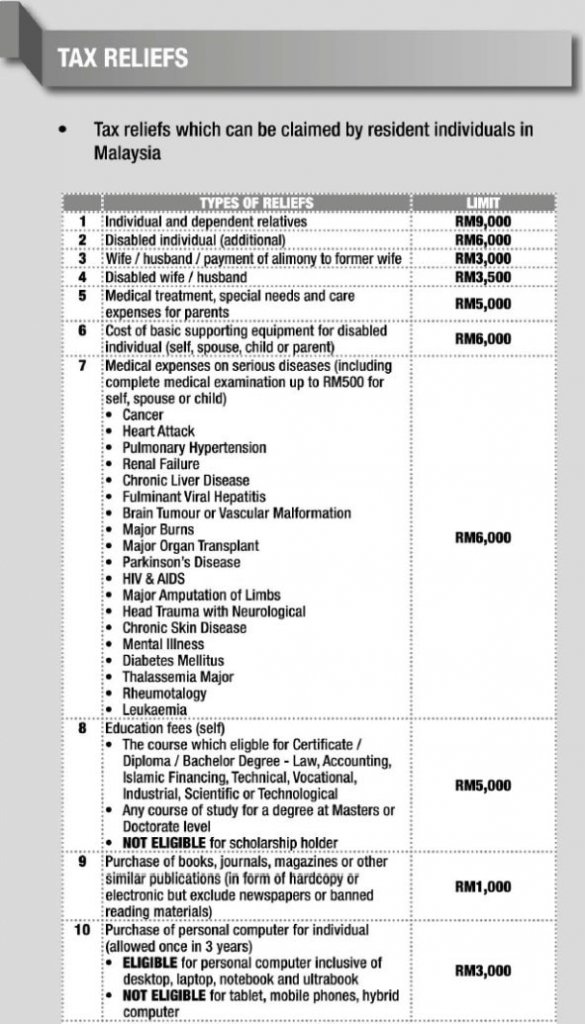

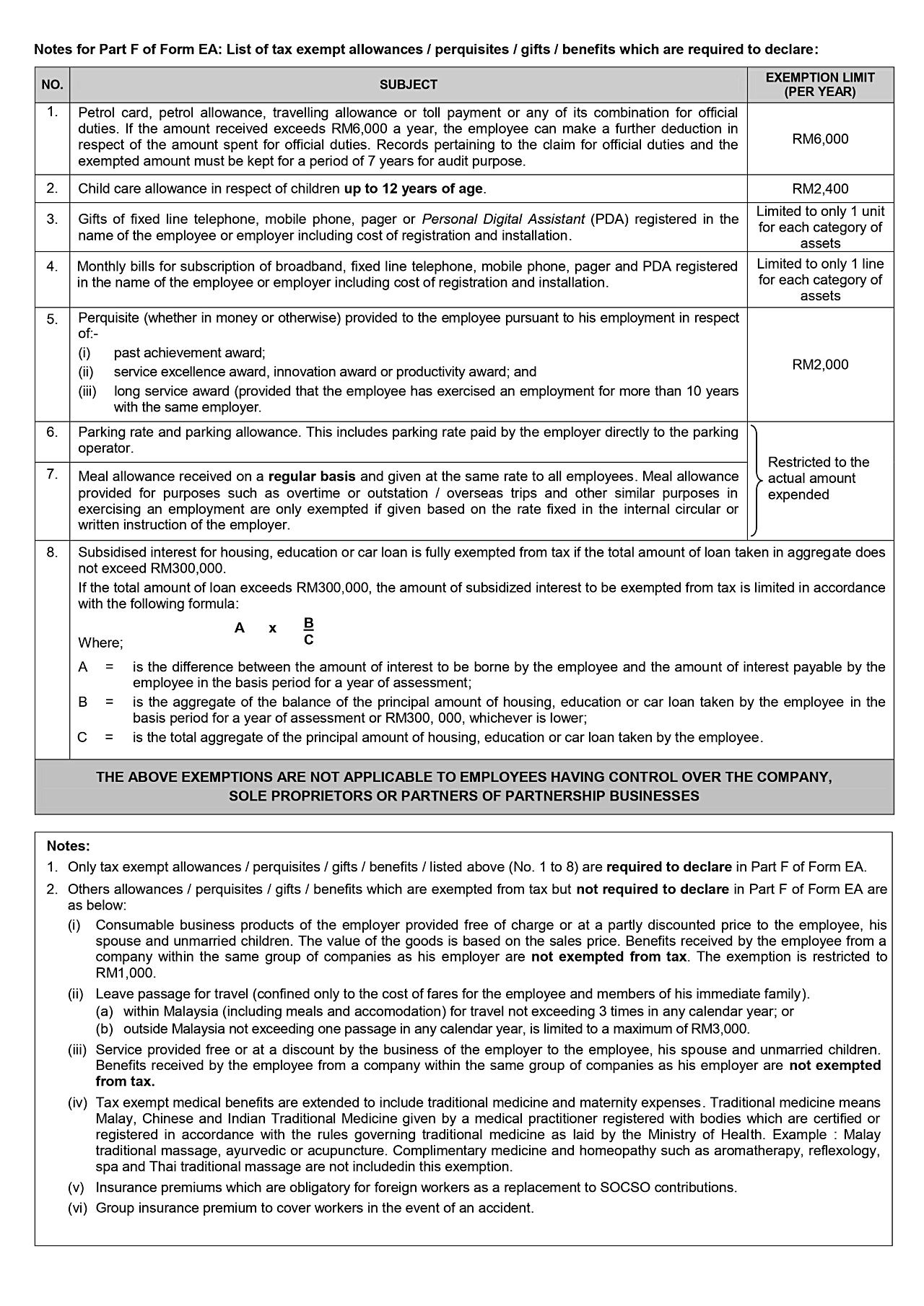

. Facility approved by the Ministry of Health any approved healthcare centre TYPE OF DEDUCTION LIMIT NONE Gifts of artefacts manuscripts or paintings to the Government Gift of painting to. Guidelines Under Subsection 446 Of The Income Tax Act 1967. TAX computation has never been easier.

Gift of money or cost of. Let us introduce you to the Tax Software that your. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara.

Gift of money to the Government State Government or Local Authorities. Where can donation under subsection 446 of the ITA 1967 be channeled. Gift of money to Approved Institutions or Organisations.

Subsection 44 6 2. List of approved organisations for donation deductions You can claim deductions for donations to certain voluntary organisations and religious and belief-based communities which have. What form of donation is allowed under subsection 446 of the ITA 1967.

Lhdn Approved Donation List Register As A Taxpayer With Lhdn Docx Register As A Taxpayer With Lhdn Registration And Status Checking Can Be Done Online At Edaftar Hasil. D Expenditure incurred in providing services public amenities and contribution to a charity or community project. Income including donation received in the previous year for the activities which were approved to achieve its objectives for the basis period for a year of assessment.

In this regard the MOF has approved a tax deduction for contributions and donations in cash and in kind by individuals and corporates to the Covid-19 Fund and the. Taking into account the suggestion. 35 Board of Trustees At.

Is my donation tax deductible. Headquarters of Inland Revenue Board Of Malaysia. C Donation to libraries.

Cash donation to publiclibrariesandlibrarie RM20OOO of school and institutions of higher education Gift of money or contribution in-kind for the NONE provision of facilities in. Amount is limited to 10 of aggregate income Subsection 4411B 4. If you are a Malaysian citizen you are entitled to tax exemption for all cash donations as defined under sub-section 44 6 of Income Tax Act 1967.

Please re-login to continue. Lhdn Approved Donation List Register As A Taxpayer With Lhdn Docx Register As A Taxpayer With Lhdn Registration And Status Checking Can Be Done Online At Edaftar Hasil. He encourages donors to perform donations through One Hope Charitys official website mobile app.

Details required are compulsory and the official receipts will be provided immediately. Gift of money or cost of contribution in kind for any Approved Sports Activity or Sports Body. EA-Link System Sdn Bhd is commited to help you optimize your business and procedures.

Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under. Amount is limited to 7 of aggregate. E Expenditure incurred in providing and.

Gift of money made to any approved institution organization or fund approved by the DGIR is also allowed as a deduction but restricted to 7 of the aggregate income of an individual.

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

Ctos Lhdn E Filing Guide For Clueless Employees

Screenshot 2016 07 20 09 01 26 Png

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Opening The Self Concept For Persuasion Persuasion Blog

Income Tax Lhdn Runner 010 28 323 62 Facebook

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Donate Today Donate Dignity For Children Foundation

The Complete Income Tax Guide 2022

How To Get A Clothing Donation Tax Deduction Toughnickel

Ways To Give Donate Money The Salvation Army Malaysia

Covid 19 Vaccination In Malaysia Wikipedia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Tax Deductions For Donations To Covid 19 Funds

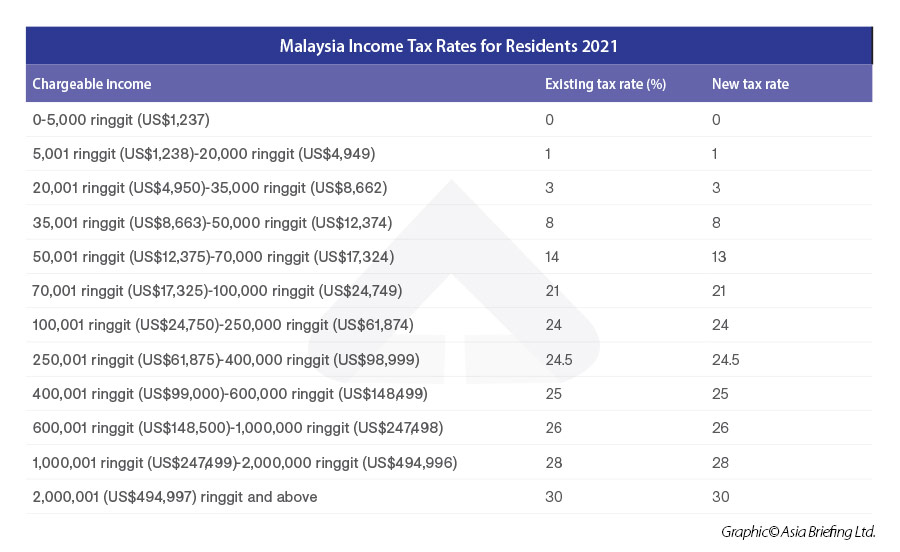

Individual Income Tax Amendments In Malaysia For 2021

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Comments

Post a Comment